Hello there so child care expenses are something that we talk about often well I talk about often, and they're sometimes a little confusing because what can you detect what you cannot deduct what our child care expenses I guess is really the question that we're trying to answer so let's first just talk about the limits, so you can deduct on your personal taxes you can deduct your childcare expenses for a child under 7 you can deduct up to $8,000 and for chow between 7 and 16 you can deduct $5,000 up to $5,000 but what are they child care expenses are expenses that you had to pay for somebody like my caregiver like somebody that came into your house like a nanny that looked after your kids or if they went to boarding school or a boarding camp, or maybe they had like a nursery center that they went to or sometimes people get childcare receipts from their schools because I guess I mean when I was a kid this wasn't a thing, but I keep seeing these receipts from schools for lunch hour supervision that count as childcare so their expenses that you have for your kids to be able to go to work to go to school or to do research, so those are the three things so if you're at home, and you're just chilling, and you don't have any you're not making any money by having your kids in daycare then you can't deduct those child care expenses I've never seen this before I've never seen somebody who has their child in daycare but then also doesn't go to work or like to go and do one of these things so if you have childcare expenses you probably it probably applies that you...

PDF editing your way

Complete or edit your Child Care Receipt For Tax Purposes anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export Child Care Receipt For Tax Purposes directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your Child Care Receipt For Tax Purposes as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Child Care Receipt For Tax Purposes by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Child Care Receipt For Tax Purposes

About Child Care Receipt For Tax Purposes

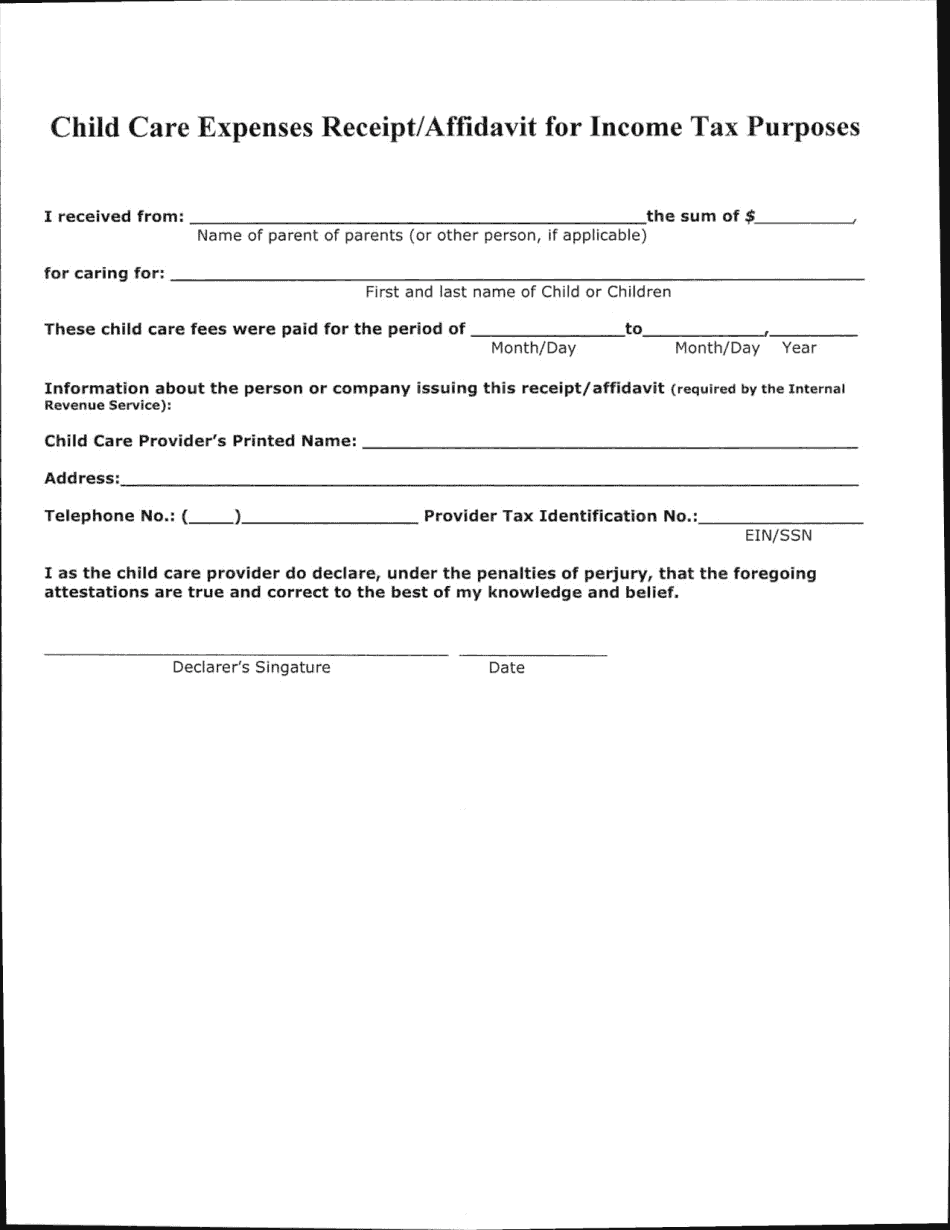

A child care receipt for tax purposes is a document provided by a child care provider to the parents or guardians of a child who receives care services. This receipt is used to claim daycare expenses as a tax deduction or to apply for child care tax credits when filing income tax returns. The receipt typically includes important information such as: 1. Name and contact details of the child care provider. 2. Name and contact details of the parent or guardian. 3. Name(s) and age(s) of the child(ren) receiving care. 4. Total amount paid for child care services during a specific tax year. 5. Dates and duration of care services provided. 6. Any additional information required by the local tax authorities. This receipt is essential for parents or guardians who wish to claim child care expenses as a deduction or apply for child care tax credits on their income tax returns. It helps to substantiate and provide evidence of the actual expenses incurred for child care services. By providing the receipt to the tax authorities, parents or guardians may be eligible for certain tax benefits related to child care costs, which can help reduce their overall tax liability.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do child care receipt for tax purposes, steer clear of blunders along with furnish it in a timely manner:

How to complete any Child Care Receipt For Tax Purposes online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuation.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your Child Care Receipt For Tax Purposes by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Child Care Receipt For Tax Purposes from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

What people say about us

Submitting forms online saves your time and effort

Video instructions and help with filling out and completing Child Care Receipt For Tax Purposes