Award-winning PDF software

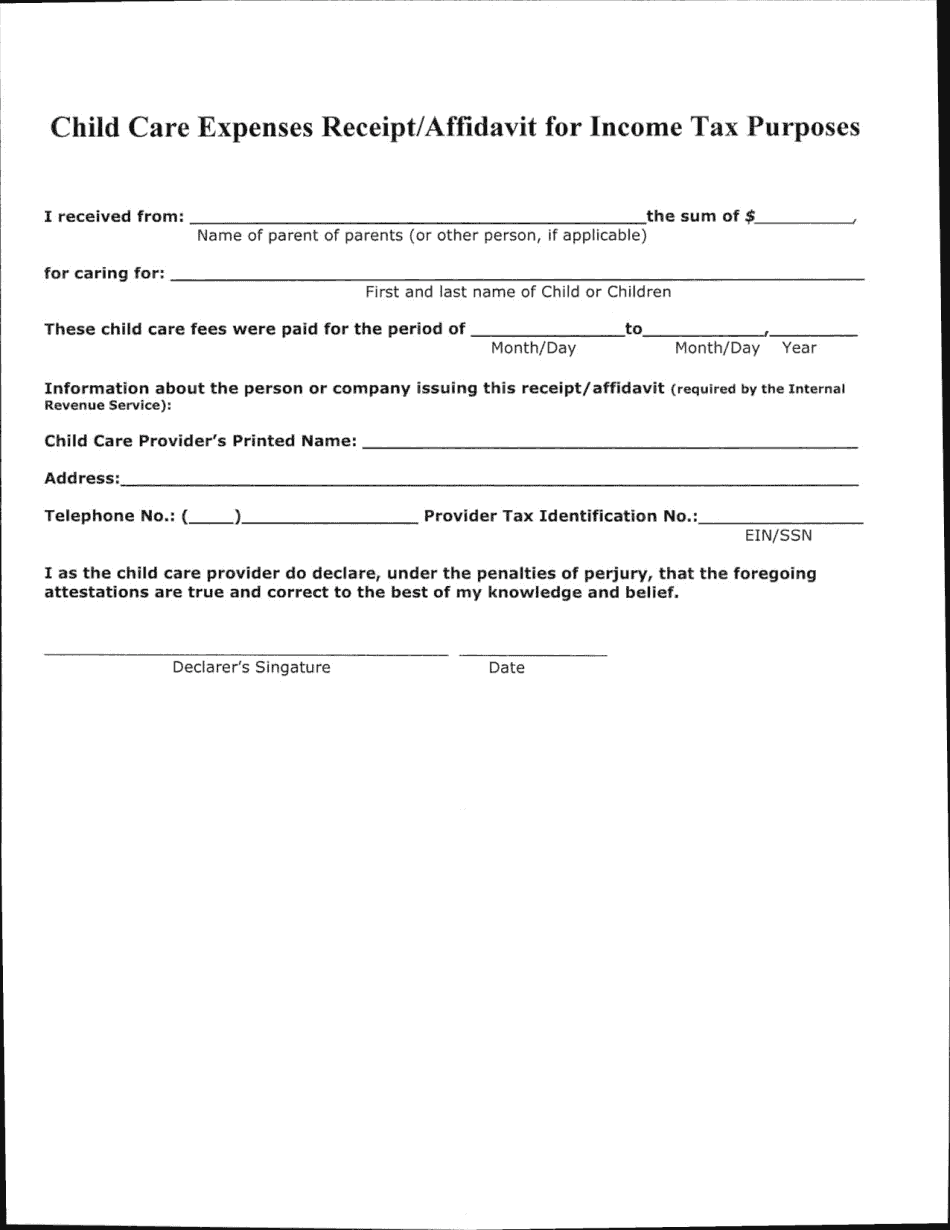

Child Care Receipt For Tax Purposes: What You Should Know

How to Use a Child Care Certificate — IRS The Certificate is a paper document which can be used alongside IRS Form 2441 to make a Childcare Reimbursement Claim for a Qualifying Child or Qualifying Spouse — IRS May 11, 2025 — Use Form W-2G to report childcare assistance and child care expenses on your tax return, unless you have an Individual Taxpayer Identification Number (ITIN), Form W-2G is not necessary to report childcare expenses on a child tax return June 4, 2025 — All taxpayers are still eligible for a free childcare tax credit, except low-income taxpayers. See more about the changes to the tax credit.

Online solutions make it easier to to organize your doc administration and increase the productiveness of the workflow. Stick to the short information as a way to finish Child Care Receipt For Tax Purposes, refrain from glitches and furnish it in the timely fashion:

How to accomplish a Child Care Receipt For Tax Purposes on line:

- On the website along with the kind, click Launch Now and go on the editor.

- Use the clues to complete the pertinent fields.

- Include your personal data and make contact with information.

- Make sure that you simply enter correct facts and figures in ideal fields.

- Carefully test the information within the type in the process as grammar and spelling.

- Refer to support part if you have any thoughts or deal with our Service team.

- Put an digital signature in your Child Care Receipt For Tax Purposes aided by the guidance of Indication Software.

- Once the form is done, press Completed.

- Distribute the ready form by way of e-mail or fax, print it out or conserve with your equipment.

PDF editor helps you to make alterations with your Child Care Receipt For Tax Purposes from any web linked equipment, personalize it as outlined by your preferences, signal it electronically and distribute in different means.