Award-winning PDF software

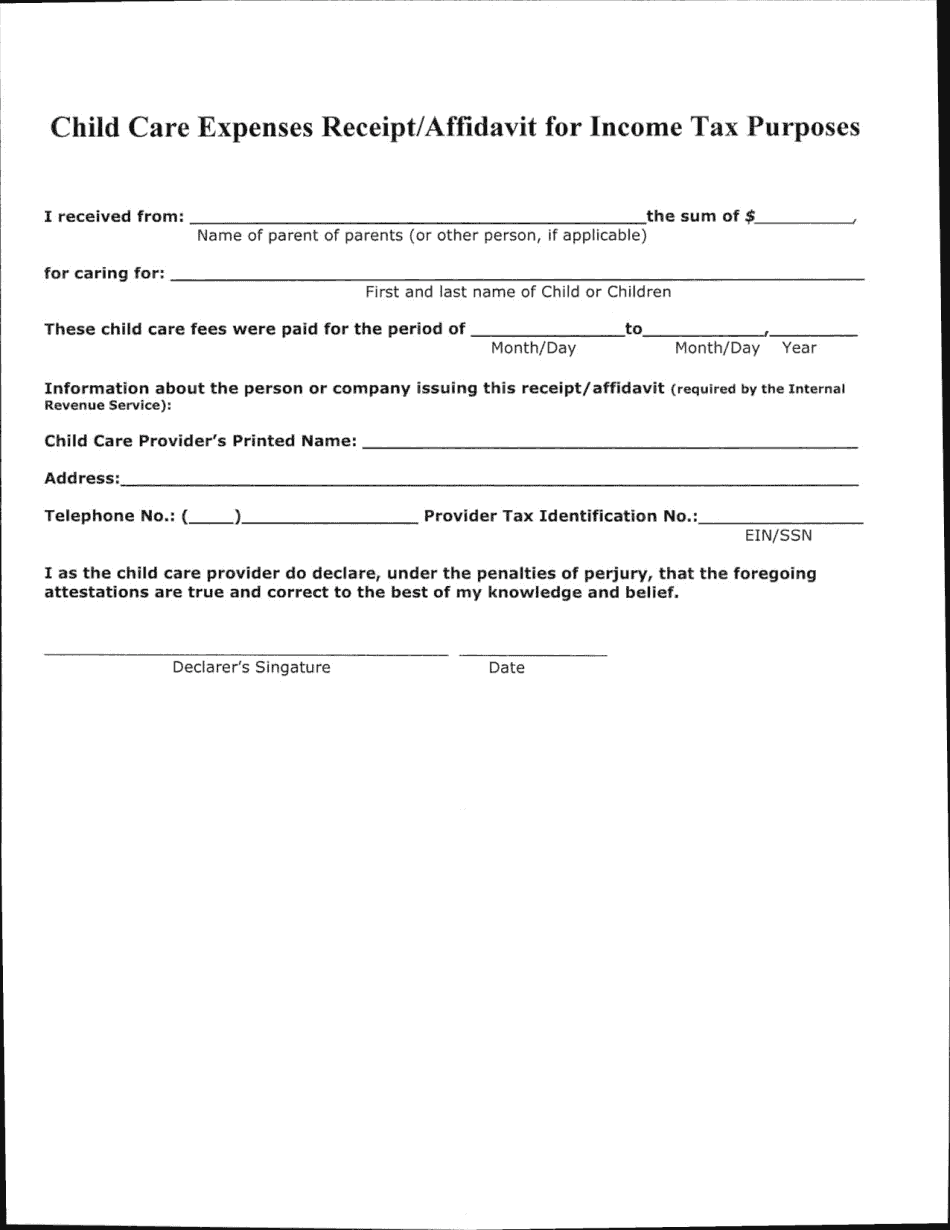

Babysitting receipt template - fill online, printable, fillable, blank

It's a new online service for helping you keep track of your tax return. You can fill your form, save it and see your tax return online! This is an excellent step you can take if you get tax refunds, tax credits and your employer may be sending out your child care credit! Get Started Now! Sign up for Tax-Deferred Student Many of our family members have recently taken on more school-related costs than our previous jobs provided. Whether it's their college tuition or other college related expenses, this step is a crucial part of the transition we've undertaken. If you're moving up in the military, a military spouse or are eligible for military tuition reimbursement, consider this as an important way to save. Start the transition by signing up for an annual tuition account. Here are some basic facts about the new 529 College Savings Plan. With the 529 College Savings Plan,.

End of the year daycare receipts - little sprouts learning

The second one is a daycare receipt sheet. A single parent can only use the first two sheets, while two parents can each fill the other one out! Here is the template: How does it work? The template requires you to include a check for the full price for daycare and a statement from the center. Make note of the daycare's day number and time, the mom, dad and family you are sending the child to the day care. If you have kids that are in day care for the month, write the month you received information on (January, February, March, etc). If you're sending the child to daycare during an upcoming month, make sure to include your address, phone number and e-mail address at the end of the form. Make sure the child is enrolled in school and has all the necessary records and forms completed. Include the tax filing.

Deducting summer camps and daycare with the child - turbotax

For a child and dependent care credit, the Qualified Child's income shall be the net income of a child or other children whom the Qualified Child and his or her spouse who is age 18 or older meet the following requirements: 1. The Qualified Child. For the purpose of receiving a credit, the Qualified Child shall be a child who is either born during the eligible period or is born to an eligible employee after December 31, 2017. Child sons born to an eligible employee who is age 18 or older on the first day of calendar month after December 31, 2017, and married to another eligible employee is considered a child and eligible employee. 2. The eligible employee and the child have the same marital status. 3. The Qualified Child and dependent (s) together meet the child and dependent care test (section 1(4)(a)) for the entire tax year under section 3 of the.

The truth about end-of-the-year parent receipts - tom copeland

For the tax year 2015, the credit for the first child is up to 1,150. The payment must be made before November 15, 2015. The payment must be made even if the first child is due any time after that date. The best way to make payment is by direct deposit to the Department of Health and Human Services , or by deposit made through Direct Deposit Express, a service provided by the Federal Reserve. A federal tax liability could be imposed on the parent's wages when the employer fails to make a proper contribution to the family trust fund. The IRS recently sent out form 2441 for child care expense for the year 2015. The child care credit is now available up to the first baby. What are your tax situations? I am planning on having 3 children. The money that I will be splitting up between them should be tax-free; however, I.

How to make a receipt for childcare - pocketsense

PDF versions of my book for I also have a free e-book .pdf of a 10 part online course called How to Pay Child Tax Credit (PDF) .